GEORGETOWN – Despite the voters rejecting a $3 million tax increase last year, town officials here are preparing to ask their property owners this spring to approve a $6 million increase in their property taxes.

The tax increase, which would be above the 2.5 percent hike the state allows, may be levied over two years — $4 million for 2026 and $2 million more for 2027.

At that level, projections are that property taxes on a $750,000 house in Georgetown would rise almost $2,000 over the two-year span.

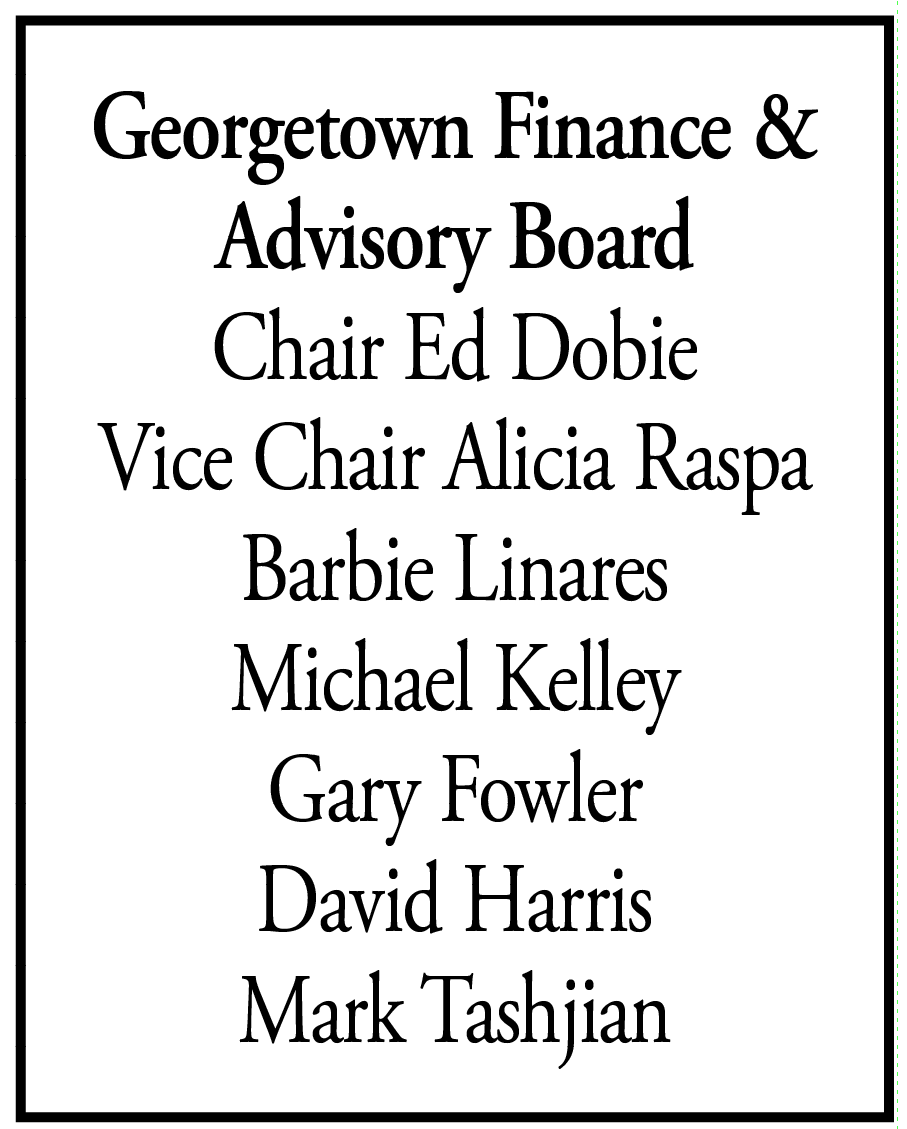

The town’s seven-member Finance Advisory Board voted unanimously last week to recommend to the SelectBoard that it put the two-year, $6 million increase on the warrant for Town Meeting to approve in May.

If Town Meeting approves the tax increase, the town would hold an election for the voters to approve or reject the increase.

Committee Chair Ed Dobie, who described the town as being at a “crossroads,” said he is worried about whether the residents will approve such a large tax increase. And he is equally worried about how residents can afford to pay for it.

“We don’t want (the proposed tax increase) to be dead on arrival,” Dobie said.

Alicia Raspa, the committee vice chair, said the tax increase is long overdue. “It should have been passed several years ago.”

Dobie said his first stop this week will be a visit at the senior center to explain the increase to the older citizens, who traditionally oppose large tax increases.

The committee, working with Town Administrator Orlando Pacheco, considered several levels of tax increases. The lowest level was an increase of $800,000 to $1 million, which would fund the town’s existing budget, but add nothing more for public safety or the schools.

With an $800,000 increase, the town would probably have to stop opening the library on Thursdays, Pacheco said. “That’s how tight things are.”

The committee also considered raising taxes by $3 million, the same level that was defeated last year.

At the $6 million level, the town can fund priorities at the school, including more special education teachers and finish paying for a new curriculum. The police department could add two more officers, and the fire department could add three more firefighters.

The town could also deposit money in reserve funds, including a special education fund for the schools. The bond rating agencies like for a town to have rainy day reserve funds.

About a dozen town residents, most with children in the schools, told the Finance Committee they support the higher tax increase. Some said that if taxes are not raised to support the schools, police and fire departments, it would damage the town.

Nicole Carleo and other residents said if the town does not raise more revenue, they might have to consider moving out of Georgetown.

Several residents said they feel like the higher taxes might be approved this year.

In the 25 years that the 2.5 tax override law has been in effect, Georgetown has considered 19 overrides. Only five have passed. ♦

[Editor’s Note: Since our printing last week which noted that the Georgetown Finance & Advisory Board’s last posted minutes on the town’s website were dated in 2022, the site has been updated. However , the Finance & Advisory Board is not listed on the Board and Commission page, nor the Departments page, but must be found instead at: https://www.georgetownma.gov/government/agendas___minutes.php. where they are the 12th bulleted listing on that page. The seven-member board is appointed by the town meeting moderator.]