City and town finance managers and finance committees got their first look at anticipated state funding for next year’s budgets, when the Massachusetts’s governor recently unveiled her budget proposal for FY26.

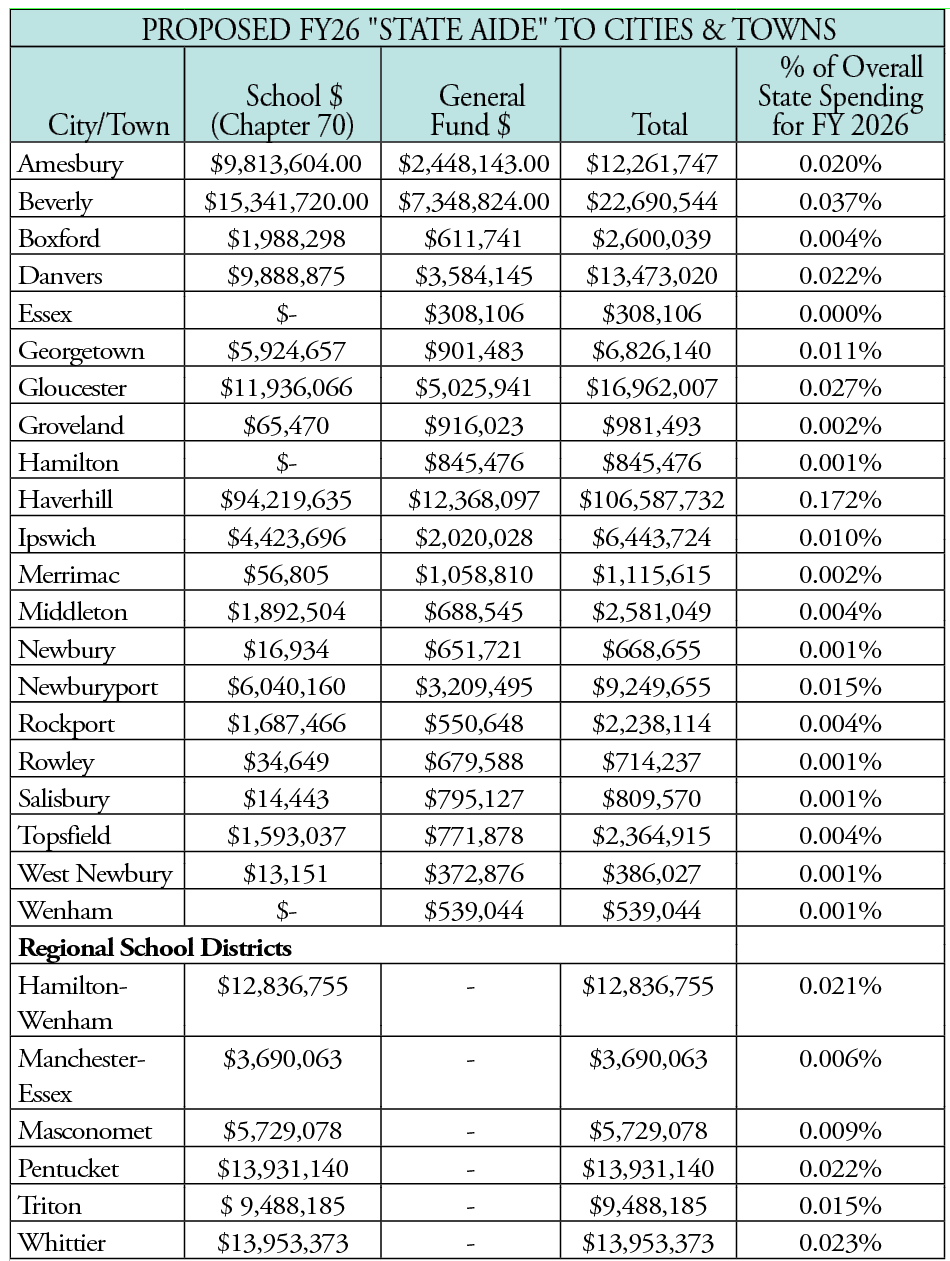

The currently proposed state spending of approximately $62 billion represents a 6.8% increase of the budget the governor signed last year, and a $10 billion increase since FY 2023. However, money distributed to cities and towns remains at sub-fractions of the overall budget (see table below).

To reach the higher levels of spending, the governor is digging deep to find new sources of revenues (including seeking to tax candy, and yes, Valentine’s Day chocolates, as well as other tax-raising initiatives).

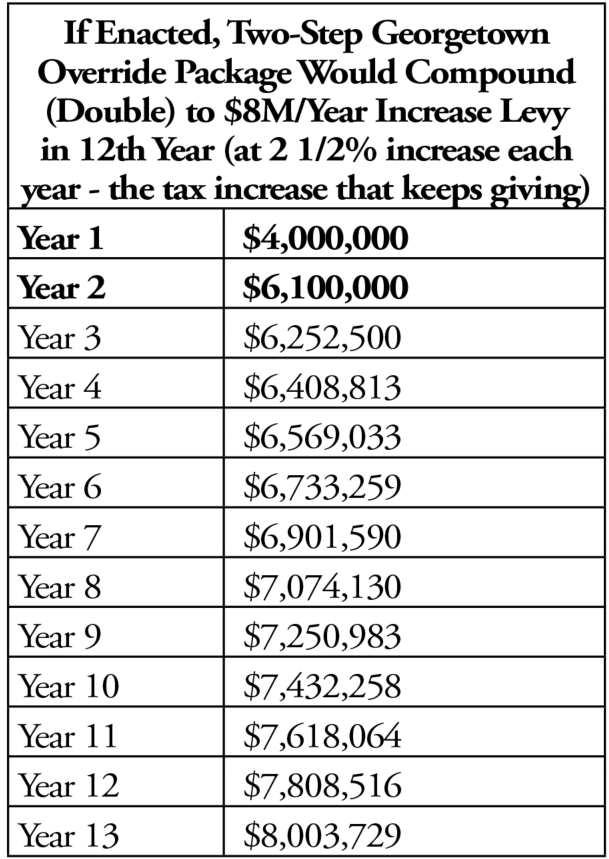

While $62 billion will be spent state-wide, budget concerns remain locally: In Georgetown where, faced with weak state funding support (“state aide”), the Finance & Advisory Committee has discussed seeking a $6 million local Proposition 2/12 tax override (a 17% increase in the town’s budget). The tax override package they propose would add $4 million to the budget in the first year, then an additional $2 million the second year, and each amount would then increase each year by 2.5%, forever, unless an “underride” is requested. The compounding effect of the increases is reflected in the above table.)

The table below shows the amounts announced by the governor for school-designated (Chapter 70) monies, as well as unrestricted general funds which the cities/towns can spend on anything they desire (including schools). Also noted is the percentage that these funds represent out of the overall proposed state spending.

For example, when Ipswich receives the anticipated $6.4 million total in “state aide,” that amount will represent a total of 0.01% (1/100 of 1%) of overall state spending. Many have argued over the years that a slight increase in state spending on local schools and city/towns would significantly reduce the burdens on aging homeowners who see ever-increasing local property taxes. ♦